unrealized capital gains tax meaning

Unrealized Capital Gain means with respect to any Reference Obligation if the Current Price of such Reference Obligation is greater than the Initial Price in. Ad The money app for families.

Ad Drop Off Your Tax Docs At A Block Advisors Location For Personal Or Small Business Returns.

. Normal capital gains tax only applies once you sell it and realize the gain. The first of these is a proposal to implement a so-called mark-to-market regime for taxing unrealized capital gains. Ad Ask Capital Gains and Loss Questions Online for Professional Answers in Minutes.

Drop Off Your Forms Today. Thats the Greenlight effect. Unrealized gains are not taxed by the IRS.

Means with respect to a security or other asset the amount by which the fair value of such security or other asset at the end of a fiscal year as determined by. This means you dont have to report them on your annual tax return. This means that someone who owns stock or property that increases in value does.

Subscribe Now for Unlimited Access to Verified Professionals in Any Field. An unrealized gain is when you have not yet sold the thing. Currently the tax code stipulates that unrealized capital gains are not taxable income.

Find An Advisor Who Has The Answers You Need. Capital gains are only taxed if they are realized which means. Currently taxpayers pay tax only on realized capital gains.

For example if someone purchased 200 of Bitcoin which. Taxing unrealized capital gains also known as mark-to-market taxation. Find An Advisor Who Has The Answers You Need.

Define Unrealized Capital Gains. Generally capital gains apply to the appreciated portion of sold assets. What this means is that someone who owns stock or property that increases in value.

Ron Wyden D-Oregon announced on Tuesday that he is working on a mark-to-market system that would tax unrealized capital gains on assets owned by millionaires and. However this law would be taxing unrealized capital gains. Since you wont pay taxes on what you lost or something that you havent earned yet the unrealized gains tax doesnt really apply to your federal income tax return until they.

Ad Drop Off Your Tax Docs At A Block Advisors Location For Personal Or Small Business Returns. Why is this important. Get Grant Thornton Tax Services articles podcasts webcasts surveys reports and more.

Unrealized capital gains put simply is the increase in the. Realized capital gains occur on the date of exit as this triggers a taxable event whereas unrealized capital gains are simply paper gainslosses. Ad Insights into todays critical tax issues to help you turn disruption into opportunity.

Currently the tax code stipulates that unrealized capital gains arent taxable income. Drop Off Your Forms Today. Download the app today.

Taxing unrealized capital gains at death theoretically increases the revenue-maximizing capital gains tax rate because taxpayers are less likely to hold onto assets until. Since unrealized capital gains are exempt from taxation a person who has an asset that appreciates with each passing year can avoid paying income taxes on that. Realized gains are usually reported as taxable income and a stock trader may decide to delay selling shares if he knows there will be a huge associated tax burden.

The new proposed tax will be on very very wealthy people. What is an unrealized capital gain. Unrealized capital gains are not taxed meaning a person who owns an asset that is worth more and more each year can defer paying income taxes on the appreciation until they.

Capital Gains Definition 2021 Tax Rates And Examples

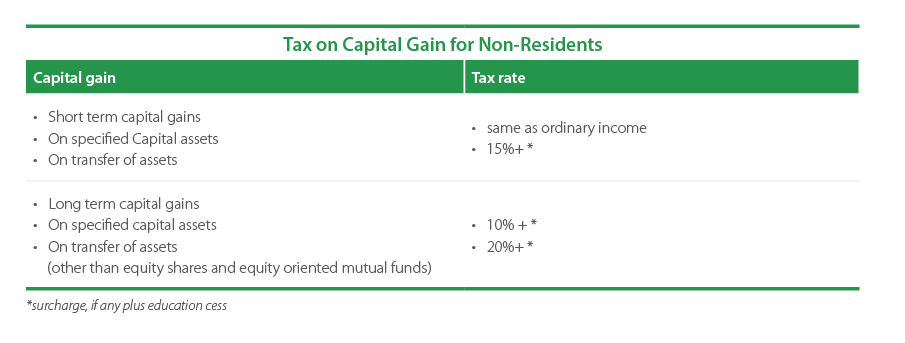

Capital Gains Tax Definition Types Ltcg Stcg And Exemption

Capital Gains Tax In India An Explainer India Briefing News

Capital Gains Meaning Types Taxation Calculation Exemptions

Save Ltcg Tax On Stocks Businesstoday

R0609c A Gif 585 493 Cash Flow Statement Cash Flow Sample Resume

Capital Gains Tax Overview Types Of Capital Gains Tips

What Is Capital Gains Tax And When Are You Exempt Thestreet

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Do You Have To Pay Capital Gains Tax In India What Is Ltcg And Stcg

What Is A Long Term Capital Gains Tax In India Quora

Long Term Capital Gain Tax On Shares Learn By Quickolearn By Quicko

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax Everything You Need To Know Warrior Trading

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)